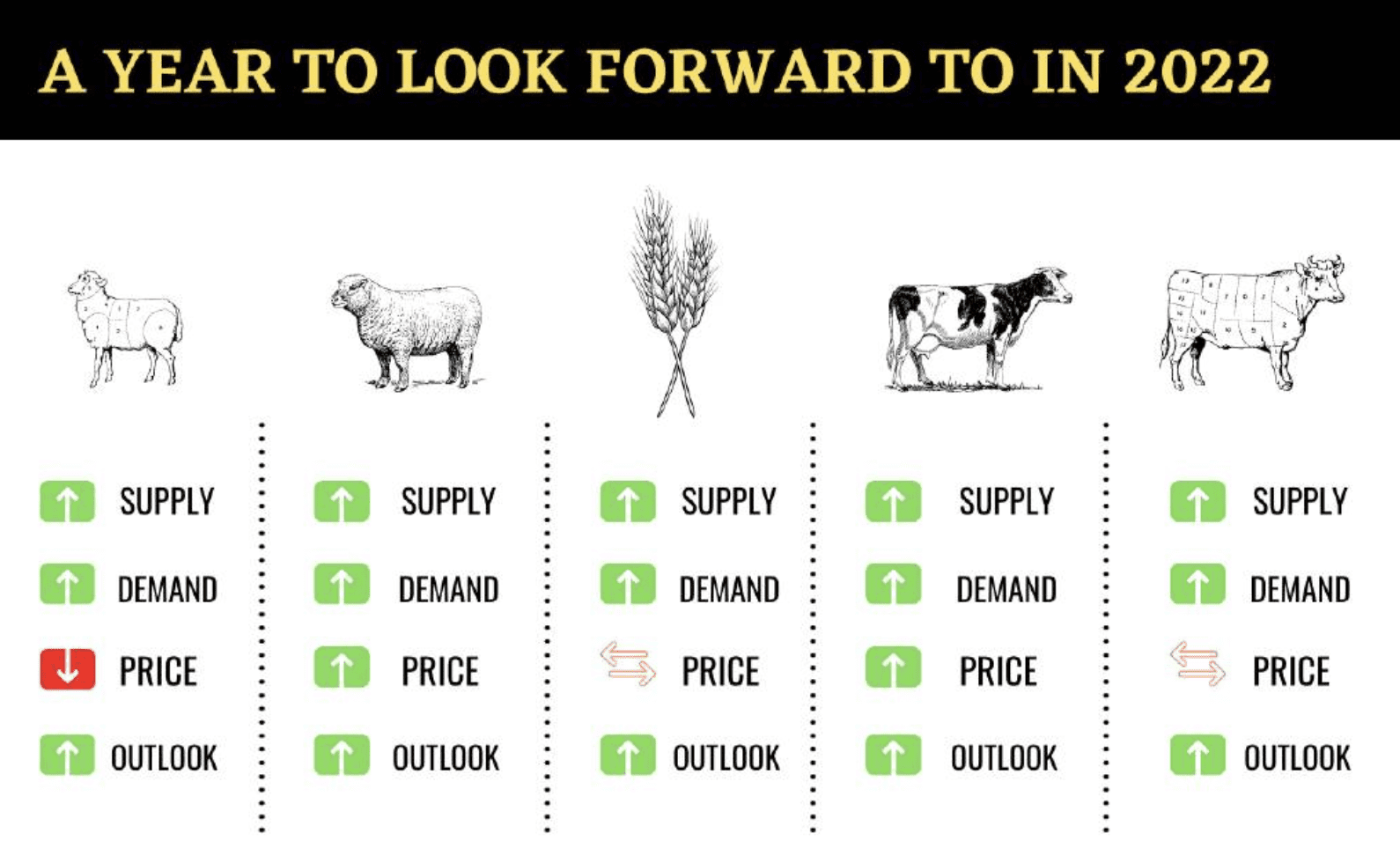

Rural Bank’s rosy 2022 forecasts

Beef prices might steady a little, grain growers should do well despite wheat quality downgrades, dairy prices will stay high, lamb will be in demand and fine wool will be just that, fine.

Those, in a nutshell, are the Rural Bank Australian Agriculture Outlook’s predictions for 2022.

While the bank’s forecasts show some sectors are likely to be better off than others, they all have one theme in common: La Nina.

The season would drive increased production of beef, sheepmeat, wool, dairy and production, making it more important than the pandemic recovery, trade conditions and supply chain disruptions.

Flatter cattle prices

FLATTER CATTLE: Rural Bank expects beef cattle prices to flatten in the first half of 2022.

The Eastern Young Cattle Indicator shot up two years ago and kept on breaking records. Rural Bank thinks that remarkable run might taper, with the curve flattening as local supply rebuilds.

Australian beef production is expected to lift 12 per cent in the first half of 2022 as more cattle reach ideal slaughter weights and the herd grows 5.6pc.

Still, the bank’s analysts don’t see a crash coming, pointing to firm restocker demand, provided there’s no cold, dry autumn, coupled with a likely 4pc decrease in global supply.

“Support for prices is likely to outweigh the downwards trending factors and keep the cattle prices at well above average values for the next six months,” the report said.

Beef exports are expected to rise 15pc as the global foodservice sector recovers.

Wheat dodges bullet

WHEAT WONDER: Rural Bank is forecasting wheat prices to remain high by historical standards.

Rural Bank’s outlook for cropping is all good news, almost.

“Contrary to previous seasons where production has been weighted to either the east or west, all states are expecting above average yields with New South Wales and Western Australia the standouts,” the report said. “While production is positive, quality is less so.”

Wheat production is forecast to be well above average at 34.5 million tonnes, and barley should reach 12.7mt, despite a smaller sowing.

Total winter crop production might be a shade below the 2016/17 record at 57.7mt, but less than 40pc of the national wheat crop thought to make milling quality. NSW’s been hardest hit, with at least half its wheat produced downgraded.

That would normally deliver cheap feed for livestock producers but not this year, Rural Bank head of sales east Andrew Smith said.

“Whilst the fact that feed wheat is trading at $100-plus per tonne below milling quality has attracted some attention, that doesn’t equate to meaning feed wheat is cheap,” he said.

“Certainly, feed wheat prices aren’t as bad as they could be, and they’re nowhere near as bad as the drought years.”

The global shortage of milling wheat pushed high-protein grades to near-record prices, with Newcastle zone FED1 trading around $275/t, equal to Australian Premium White in April 2021.

Unless there’s strong northern hemisphere production, Rural Bank believes prices will remain at decile 6-7 into late 2022, with potential upside of 10pc as Russian export limits begin early next year. Barley prices will likely stay put.

Coasting canola

CAN DO: Plantings of canola have expanded and the price is likely to remain attractive for growers in 2022.

Canola production is forecast at a record 5.5mt, with growers estimated to have planted almost 30pc more area to canola this year.

Low global supply and very high export demand will see prices remain at record levels but may not reach the highs of over $1000/t seen earlier in the season.

“While prices may not reach those levels again, there is very little further downside to canola prices and fundamental supply and demand factors mean they are unlikely to drop below $800 per tonne,” the report said.

Pulses patchy

PROBLEM PEA: Chickpea demand and pricing is being hampered by transport and supply chain issues.

The outlook for pulses is less positive. As wheat and canola monopolise bulk transport infrastructure, supply chain problems are likely to hamper export demand and subdue prices.

Only lentil prices remain relatively high, supported by India’s temporary reduction of the import tariff from 30-10pc. Canada’s drought will firm demand for Australian lentils.

Dairy demand

National milk production should creep up 1-2pc, with flat global milk supply.

Global skim milk powder prices are 45pc, and cheddar 31pc, above the five-year average.

Export demand from key markets looks good, with Rural Bank calling China the one to watch after January to September imports rose 50pc in value year-on-year.

Domestic foodservice demand is expected to recover in the first half of 2022.

Farmgate milk prices have settled at an average $7.02 a kilogram of milk solids across major southern milk processors, 6.2pc higher than the five-year average.

Sheep’s small dip

TOP CHOP: Lamb prices are likely to continue the same long-term trend.

“Lamb and mutton supply is expected to increase, which should coincide with increased demand as international markets recover from the impacts of COVID-19,” Rural Bank regional manager agribusiness Simon O’Leary said.

“Improved demand will support the continuation of strong prices, however a drop is inevitable on the back of increased supply.”

Demand for sheepmeat, particularly lamb, is expected to build globally in the first half of 2022 and remain strong as consumers return to pre-pandemic lifestyles, meeting supply growth.

Rural Bank said anticipates the eastern states trade lamb indicator will trend towards 750-800 cents a kilogram.

Wool’s fine 2022

The new year bodes well for growers in 2022 with pent-up consumer demand delivering gradual increases. The Eastern Market Indicator is likely to average about 1400c/kg but the gulf between fine and medium microns will continue.

“Domestic and international buyer interest will support prices, but some volatility is expected due to changing market conditions,” Rural Bank agribusiness relationship manager Fiona Whale said.

While natural fibres represent a smaller market share than synthetics, high oil prices and changing customer attitudes helped wool and cotton remain competitive.

There was optimism retail spend on natural fibres would increase, Ms Whale said, as consumers used their lockdown savings on more sustainable goods.