Virtual property valuation platform launched

Global food and agribusiness bank Rabobank has just rolled out world-first technology that enables virtual rural property valuations but some in the industry are hesitant to believe a computer can do the job accurately.

CSIRO-backed start-up Digital Agriculture Services (DAS) has created the Rural Valuations Hub, a software-as-a-service product that is helping Rabobank conduct property appraisals virtually, both complementing physical inspections and assisting in circumstances where these are not possible.

Rabobank Australia chief operating officer Andrew Vickers said while the solution was co-created over three years to meet a specific industry-wide need, its value had been proven during the COVID-19 lockdowns.

“While Rabobank is very much a relationship bank focused on personal contact with our clients, we are also committed to launching innovative solutions that benefit both our customers and internal teams,” Mr Vickers said.

“We partnered with DAS to create and launch a rural valuations platform and solution that would improve property appraisals and workflows by taking advantage of advanced technological approaches to make more informed assessments.”

He said the platform had helped promote Australian agriculture as an essential business during COVID-19.

“We have been able to support the business continuity of an essential industry by using the Rural Valuations Hub to undertake rural property valuations when they weren’t able to be conducted in person because of the lockdown restrictions,” he said.

DAS and Rabobank first piloted the platform in 2019 before rolling it out earlier this year.

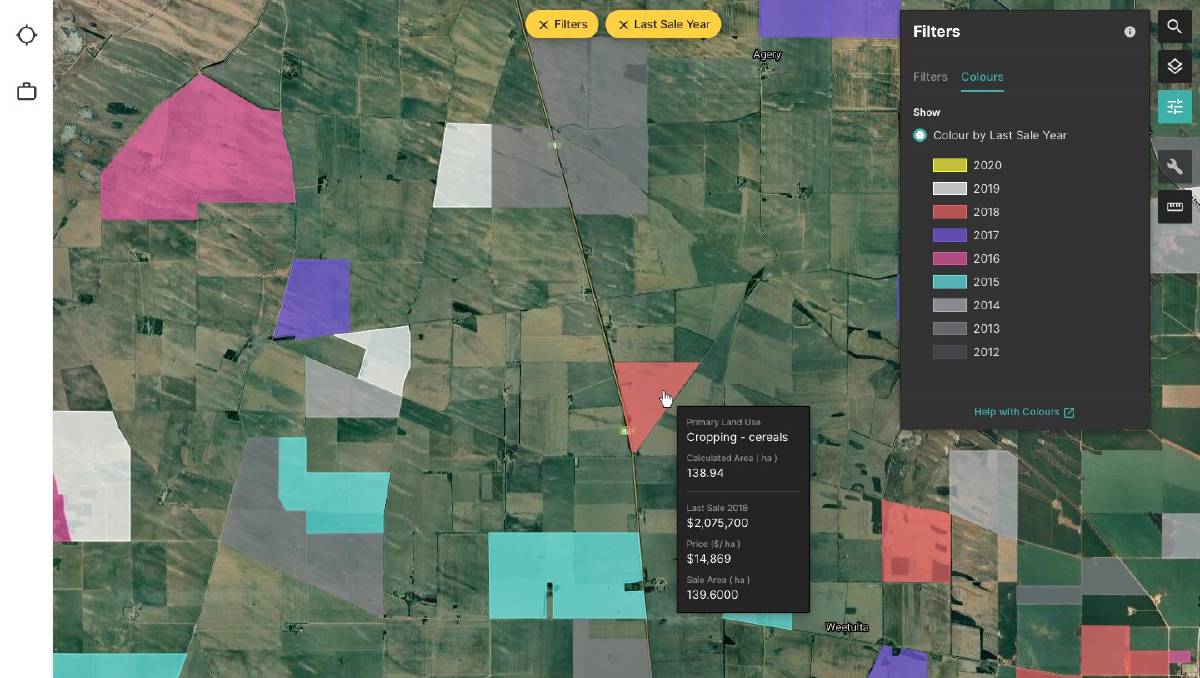

The Rural Valuations Hub offers a digitised appraisal and valuation workflow, appraisal reports, comparative sales analysis, custom capabilities and science-supported, standardised insights and data.

It is also designed to scale globally, supporting farmers, clients and business continuity in weathering COVID-19 and other disruptions.

In the next phase of the partnership, Rabobank plans to implement the solution to additional markets outside of Australia, as well as explore how the technology can be applied to areas like climate risk and portfolio management.

When it came to digital advancements, DAS co-founder and chief executive Anthony Willmott said financial services that failed to invest in rapidly advancing technology, such as machine learning, would become uncompetitive in years to come.

“We have found that the best way to drive advantages faster is to complement what we’re doing with a co-design partnership,” Mr Willmott said.

“The work we’re doing on this strong performing digital platform provides efficient and compliant appraisals, but the real power is what the technology enables, including portfolio management and understanding the impact of climate change and extreme events.”